Introduction

In an era of inflationary fiat currencies, Bitcoin emerges as a transformative asset class. Unlike traditional systems that erode purchasing power, Bitcoin’s fixed supply of 21 million coins offers a compelling case for wealth preservation. For investors seeking to protect and grow their wealth, understanding Bitcoin’s role in the macroeconomic landscape is crucial. This article explores Bitcoin’s investment potential, drawing on valuation models and growth forecasts to guide informed decisions.

Bitcoin vs. Fiat: A Fundamental Divide

The global financial system relies on inflationary fiat currencies, where money supply expansion (e.g., 7–10% annual M2 growth) and rising national debt devalue purchasing power. Bitcoin, with its capped supply and decentralized protocol, operates differently. Its scarcity makes it a potential store of value, competing with assets like gold, real estate, and bonds. As fiat devaluation accelerates, Bitcoin’s fixed-supply model positions it as a hedge for investors, business owners, and high earners.

Bitcoin’s Valuation Potential

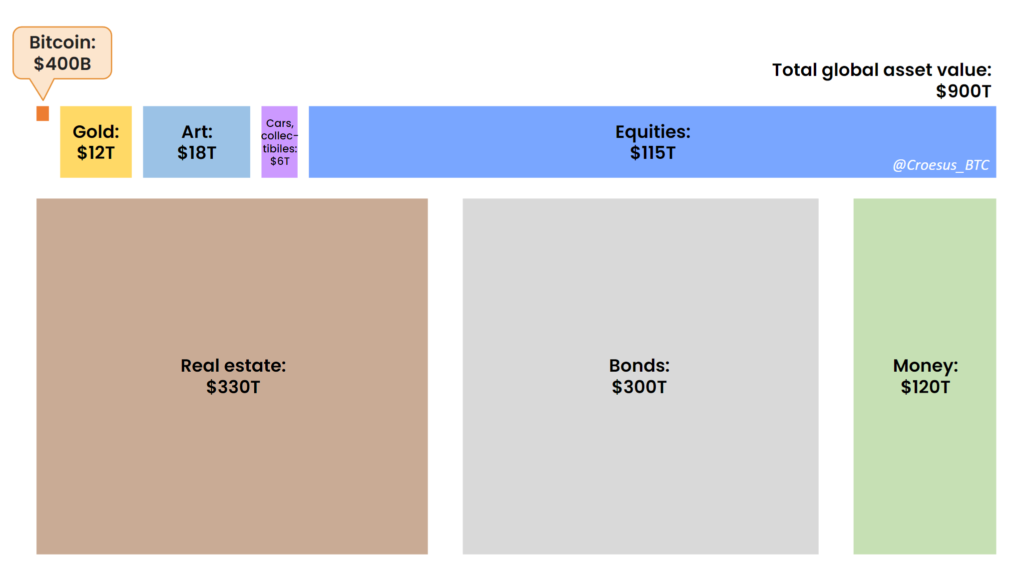

Jesse Meyer’s “Bitcoin’s Full Potential Valuation” provides a framework for assessing Bitcoin’s role as a store of value. Meyer estimates global assets at $900 trillion, representing Bitcoin’s total addressable market. Unlike traditional assets, Bitcoin’s unique properties—portability, divisibility, and censorship resistance—position it to capture significant market share. Meyer projects Bitcoin could consume 25% of global asset value, equating to a $225 trillion market cap. While ambitious, this underscores Bitcoin’s potential to rival traditional stores of value as its adoption grows.

Forecasting Bitcoin’s Growth

Forecasting Bitcoin’s trajectory is complex, but the Bitcoin24 model, developed by Michael Saylor, offers a simplified tool for investors. It focuses on long-term growth without modeling short-term volatility, aligning with Bitcoin’s maturing asset profile.

- Compound Annual Growth Rate (CAGR): Bitcoin’s historical CAGR since 2009 is ~128%. The model assumes a declining rate, starting at 50% in 2025 and stabilizing at 20% by 2037, reflecting S-curve adoption dynamics.

- Inflation Assumptions: With fiat inflation averaging 6% (driven by M2 expansion and debt), Bitcoin’s scarcity becomes more attractive for capital preservation.

- Innovation Growth: A 4% annual innovation rate (e.g., AI, automation) offsets some inflationary pressures but doesn’t diminish Bitcoin’s appeal.

- Asset Monetization: Bitcoin is expected to capture market share from gold, equities, and bonds as investors recognize its value proposition.

These variables suggest Bitcoin’s growth will be driven by its ability to absorb capital from traditional assets, particularly in high-inflation environments.

Investor Profiles and Adoption Trends

The Bitcoin24 model also considers investor behavior, categorizing profiles from cautious “Normies” (0% Bitcoin) to aggressive “Triple Maxis” (100% Bitcoin with leverage and tax optimization). Most investors fall in between, with modest allocations (e.g., 10%) balancing risk and reward.

Beyond individuals, corporate and nation-state adoption is accelerating. Companies are allocating treasury reserves to Bitcoin, while debt-heavy nations view it as a hedge against fiat devaluation. Wealthy nations may also diversify reserves with Bitcoin, amplifying demand for its finite supply. This institutional uptake strengthens the investment case for individual portfolios.

Why Bitcoin Matters for Your Portfolio

Bitcoin’s unique properties and growing adoption make it a compelling addition to diversified portfolios. As inflationary pressures persist, its fixed supply offers a hedge against wealth erosion. However, investors must approach Bitcoin with a long-term perspective, given its evolving volatility and market dynamics.

Build Your Bitcoin Strategy Today

Don’t let inflation erode your wealth. Bitcoin’s potential as a new asset class offers a path to preserve and grow your financial future. At Basilic Financial, we craft personalized Bitcoin investment strategies tailored to your goals. Schedule a consultation now to unlock the power of Bitcoin in your portfolio.

Disclaimer

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment adviser to determine whether any information presented may be suitable for their specific situation. Past performance is not indicative of future performance. This is not tax, legal, or investment advice.

Basilic LLC and Wyatt O’Rourke believes that the content provided by third parties and/or linked content is reasonably reliable and does not contain untrue statements of material fact or materially misleading information. This third-party content may be dated. Content posted by third parties is not attributable to Basilic LLC or its employees, as the information within this post was not provided by Basilic LLC. Links to websites and other resources operated by third parties are provided as information only, and there can be no assurance as to its accuracy, suitability or completeness. Basilic LLC & Wyatt O’Rourke does not endorse, authorize or sponsor the content or its respective sponsors and is in no way responsible for third party content, services, products or information, or for the collection or use of information regarding the web site’s users and/or members.