Introduction

In today’s economic climate, the twin specters of inflation and stagflation loom large, threatening the hard-earned savings and investment portfolios of countless individuals. Understanding their origins and impact through the lens of Austrian economics offers a refreshing contrast to the prevalent Keynesian narratives, which often dominate mainstream economic discourse. It is more than academic—it’s essential for securing financial stability and growth.

The Austrian View on Inflation and Stagflation

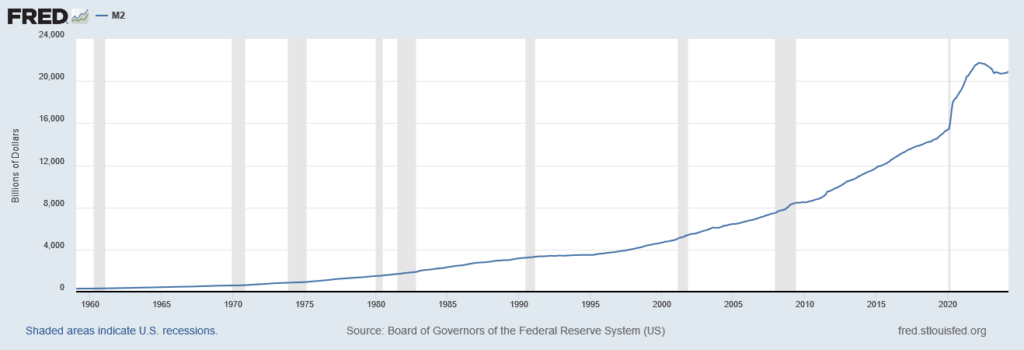

Inflation, as understood by the Austrian school of economics, isn’t merely a rise in prices but is primarily the consequence of increasing the money supply—money printed out of thin air by central banks. The Austrian school diverges sharply from Keynesian policies, where such actions are often seen as necessary tools for stimulating economic growth and centrally coordinated intervention is encouraged.

Root Causes of Modern Inflation

Today’s inflationary climate can be traced back to extensive central bank interventions, which have flooded economies with fiat currency in a misguided attempt to engineer economic stability.

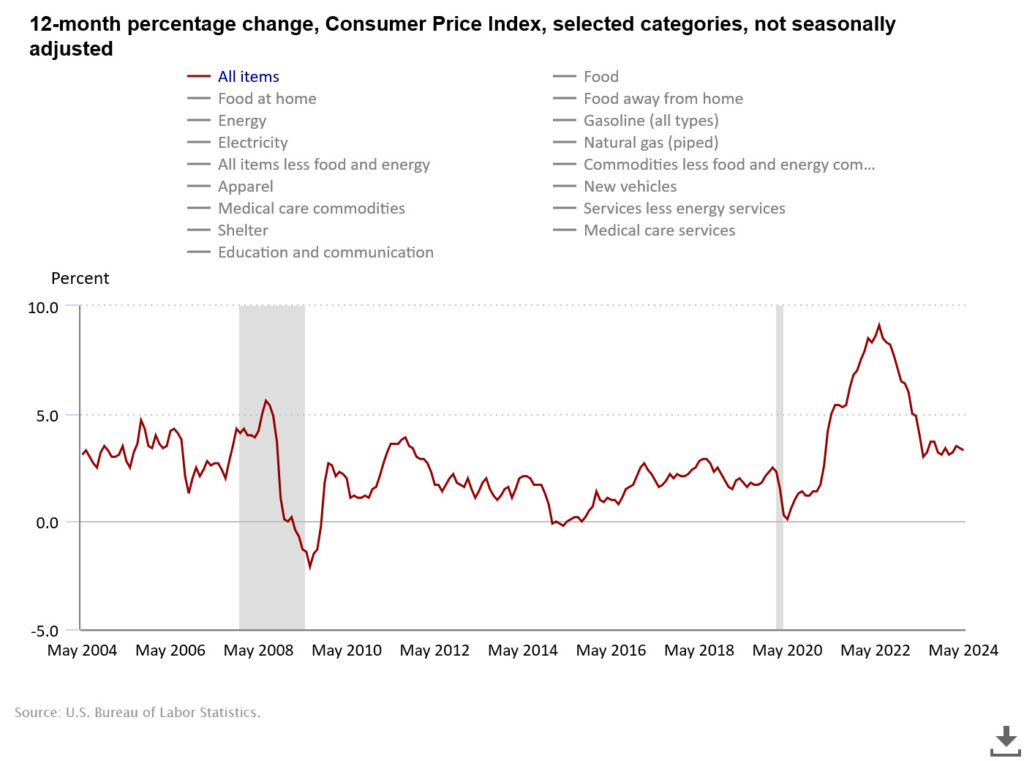

The recent spikes in inflation rates are direct outcomes of these excessive expansions of the money supply, intended to counteract economic slowdowns, but ultimately leading to the devaluation of currency and a decrease in purchasing power for individuals.

The Emergence of Stagflation

Stagflation—a toxic mix of stagnant economic growth and rising inflation—challenges the Keynesian assertion that inflation and unemployment cannot rise simultaneously. Contrary to central planners’ predictions, the current economic environment, influenced heavily by rampant monetary expansion and regulatory overreach, mirrors the stagflationary period of the 1970s, which left economies floundering with high inflation and high unemployment at the same time.

Impact on Savings and Investment

For savers and investors, the combination of inflation and stagflation erodes real returns. Traditional assets and strategies may struggle or fail to provide financial refuge, and individual results may vary as past performance is not indicative of future results . Investors are forced to seek greater return and simultaneously take on greater risk. This can manifest itself in ‘casino like’ behavior in financial markets most recently illustrated in the GameStop saga 2.0 or the fact that penny stock trading has hit all time highs. Understanding these dynamics is crucial for anyone looking to preserve wealth in these challenging times.

Critique of Central Planning

The persistent issues of inflation and stagflation underscore the limitations and often the failure of central planning. Policies aimed at controlling economic variables through monetary manipulation have repeatedly led to economic distortions, boom-bust business cycles, and unintended consequences. Austrian economics advocates for a minimalistic approach to central intervention, emphasizing that a free-market economy better allocates resources and adjusts to economic changes naturally without the need for heavy-handed monetary policies of 12 Federal Reserve Governors.

Conclusion

While the challenges of inflation and stagflation are daunting, understanding their true causes from an Austrian perspective empowers individuals to make informed financial decisions. At Basilic Financial, we recognize the complexities of the current economic landscape. We are prepared to help clients navigate various economic cycles with strategies that emphasize sound money principles and real economic value. Are you ready to approach your financial future with sound money principles? Contact Basilic Financial today to learn how we can assist you in helping safeguard and grow your wealth.

Disclaimer

Basilic LLC is a registered investment adviser. This platform is solely for informational purposes. Investing involves risk and possible loss of principal capital. Comments by viewers or third-party rankings and recognitions are no guarantee of future investment outcomes and do not ensure that a viewer will experience a higher level of performance or results. Public comments posted on this site are not selected, amended, deleted, or sorted in any way. If applicable, certain editing of personal identifiable information and misinformation may be deleted.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment adviser to determine whether any information presented may be suitable for their specific situation. Past performance is not indicative of future performance. This is not tax, legal, or investment advice.

Basilic LLC and Wyatt O’Rourke believes that the content provided by third parties and/or linked content is reasonably reliable and does not contain untrue statements of material fact or materially misleading information. This third-party content may be dated. Content posted by third parties is not attributable to Basilic LLC or its employees, as the information within this post was not provided by Basilic LLC. Links to websites and other resources operated by third parties are provided as information only, and there can be no assurance as to its accuracy, suitability or completeness. Basilic LLC & Wyatt O’Rourke does not endorse, authorize or sponsor the content or its respective sponsors and is in no way responsible for third party content, services, products or information, or for the collection or use of information regarding the web site’s users and/or members.